Lido Staked Ether(STETH)$3,064.23-0.74%

Lido Staked Ether(STETH)$3,064.23-0.74%Your investment goal should be focused on instability vs. inflation in 2022— Why?

The whole world has been suffering from rigid inflation growth in this fainted Covid era. Investors are trying to cope with the inflation race with lucrative returns. Even top economies like US and Russia are stimulating possibilities of hyperinflation amid war. Developing countries are under the trap of Covid-War-Inflation already, directly or indirectly. India is not an exception, including its subcontinent. But by the end of the FY 2021-22, the mutual fund industry had handled ₹ 37.5 lakh crore in investor assets. After the Covid-19 outbreak disrupted the previous financial year, investor confidence in mutual funds has recovered.

If you have the option to buy a single fruit or platter of fruits at the same price, definitely you will go for the second option for balanced nutrition. At its most basic level, a mutual fund is a collection of money from individuals invested in stocks, bonds, and other income-producing assets. Individual investors can buy mutual fund shares in the same manner; they buy individual stocks. Similarly, you purchase a tiny portion of Apple’s ownership when you buy Apple stock. When you buy a mutual fund share, you are purchasing a small amount of the mutual fund company’s ownership.

Choose investments that meet your risk appetite, financial goals, inflationary tendency, and other factors. Sometimes the investment is hazardous due to the focus on specific stocks and industries, but it might be highly profitable if the sector does well. Stocks will undoubtedly find a place in any investor’s equity portfolio when the fundamentals are robust and appealing. Moreover, we have to check

1) Fund’s history

2) Expense ratio

3) Net Asset Value(NAV)

4) Financial Ratios

According to Association of Mutual Funds of India(AMFI) data, the mutual fund industry had successfully mounted a 37.5 L crore club at the end of FY 2021-22. After a challenging year, investor confidence has returned to the mutual fund industry, and the market accelerated with positive outcomes :

• In the fiscal year 2021-22, small-cap schemes had an average return of 37%

• Multi cap and mid-cap schemes delivered 27.8% and 24.5%, respectively.

• Collections from Systematic Investment Plans (SIPs) reached an all-time high of ₹ 12,328 crores in March 2022, compared to nearly ₹ 11,000 crores in February.

• Large-cap funds, famous for low risk, witnessed 17.7% growth in the same financial year.

• Equity mutual funds saw a record net inflows of 1.6 lakh cr during last FY.

Mutual funds are an excellent way to increase the value of your money. If you look back in history, mutual funds have consistently outperformed traditional fixed deposits and even gold.

SIP is a process of investing in mutual funds where you can choose the investment schemes, and they can fix the amount for specified intervals. Therefore, the danger of equity volatility is reduced with systematic investment plans. In addition, systematic investment plans fund future dreams and essential goals such as retirement, a child’s education, and purchasing a home, car, or other assets.

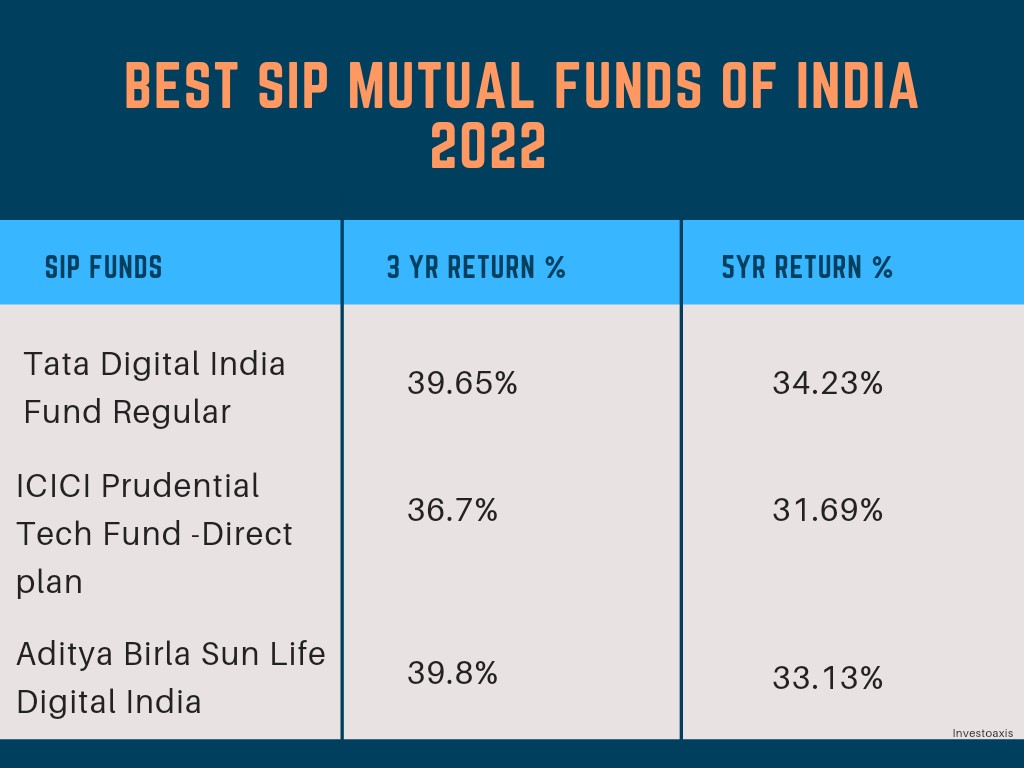

SIPs can be scheduled weekly, monthly, or quarterly, according to your preferences. Most millennials prefer SIP because they provide them with a lot of flexibility in terms of time and amount. Here we select India’s top 3 SIP mutual funds in 2022 with high returns and healthy growth.

When it comes to picking the best equity funds in India, you can’t only rely on the fund manager’s reputation. You must consider your personal objectives and risk tolerance, market trends, the growth of the companies whose stocks you intend to invest in, the level of risk involved, and the fund’s returns.

You should look at the Net Asset Values (NAVs) and returns generated by the equity fund once you understand the goals and performance measures. The NAV, or net asset value, is the price per share of a mutual fund that is disclosed daily. In India, an equity mutual fund scheme must invest at least 65% of its assets in equities and equity-related securities, according to current SEBI Mutual Fund Regulations. In addition to diversification, investors also benefit from additional factors such as tax advantages (under Section 80C of the Internal Revenue Code). Therefore, we pick India’s top 3 equity mutual funds with healthy growth and returns.

To produce interest, a debt fund invests in fixed-income assets such as treasury bills, corporate bonds, government securities, and other money market instruments. Debt funds are often considered a safer alternative to the stock market’s volatility, as they carry a lower risk but lower reward profile. Debt funds are a good option for risk-averse investors who aren’t ready to take on equity risk. Debt funds help an investor grow their money while offering little or no risk. In addition, these funds aim to provide a steady stream of income. If you stay invested for at least three years, debt funds give superior post-tax returns than FDs.

We choose top-performing or best performing debt mutual funds of India in 2022. This is because market fluctuations have little impact on the performance of debt mutual funds. As a result, unlike equity funds, these funds are less volatile. In addition, fixed-income securities make up most of a debt fund’s portfolio.

Read on if you’re new to mutual fund investing and want to know which funds can provide you a nice return while posing a low risk. Large-cap mutual funds are a good place to start for a new investor. Large-cap funds invest in blue-chip companies with a track record of good performance and consistent earnings, and their stock values are relatively stable. Here we list India’s best performing large-cap mutual funds in 2022.

Compared to mid and small-cap funds, large capital mutual funds are the safest investment inequities because they have strong returns and are less susceptible to market swings. These funds invest in large corporation equity. Despite the high share price of blue-chip businesses, investors choose to put their money into large-cap funds.

One of the most significant advantages of investing in small-cap mutual funds is the enormous potential for bigger returns. Some of the funds’ 5-year CAGR returns can be as high as 23 percent (based on past performance). Even large and mid-cap funds can’t match these huge returns. However, keep in mind that past performance is no guarantee of future results. Here is a list of India’s best small-cap mutual funds based on risk and opportunity parameters.

Small-cap funds can surge in a bullish market, providing strong returns because they are aggressive. Small-cap mutual funds with the best performance have the potential to be a cash cow. Before investing in the best small-cap funds, you need to understand the risk-reward tradeoff.

Multi-cap funds invest in a variety of market capitalizations. According to SEBI’s new mandate, they must invest 25% in large-cap, 25% in mid-cap, and 25% in small-cap companies. Top multi-cap funds invest in companies of various sizes and sectors, resulting in a diversified portfolio. This diversification technique lowers your risk.

While learning the markets, novice young investors often opt to participate in multi-cap funds. During volatile times, the risk in multi-cap funds is generally reduced more easily. The ups and downs in a stock’s sectoral or market cap size have little bearing on the performance of a solid multi-cap fund. They are your wealth creation journey’s risk regulators. Here we pick up India’s best performing multi-cap mutual funds for 2022.

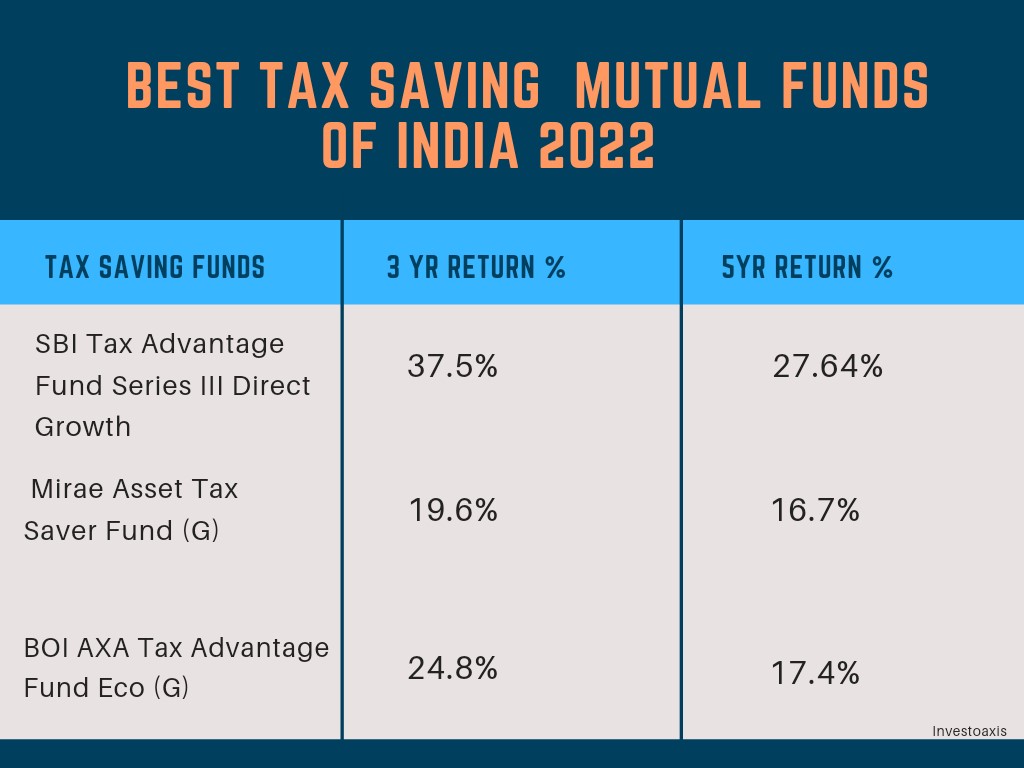

One of the most compelling reasons to invest in ELSS is to avoid paying taxes. ELSS investments are eligible for a tax deduction under section 80C of the 1961 Internal Revenue Code. However, any dividends or long-term capital gains the investor receive are tax-free. Simply put, your ELSS earnings are tax-free. Moreover, ELSS schemes cannot be withdrawn before the stipulated lock-in period expires.

The Indian government also offers a tax break for equity-linked savings schemes (ELSS) under section 80C of the Income Tax Act 1961. To lower your tax liability successfully, you can invest in ELSS and deduct up to Rs. 1,50,000/- from your taxable income. Here we provide a list of India’s best tax savings or ELSS mutual funds in 2022.

People generally feel that Mutual Funds are only for long-term investors. That isn’t the case! Short Duration Funds, also known as Short Term Debt Funds, allow investors to invest for the short term while keeping their money accessible.

Short-term mutual funds have a maturity period of 15 to 91 days. The maturity time of these funds is determined by the underlying instruments’ maturity period. These funds are mostly invested in low-risk, high-quality assets. For risk-averse investors, this fund is a fantastic financial choice. Liquid funds are an excellent alternative for temporarily storing excess funds (less than a month). Ultra-short-term funds are appropriate for investors with a longer investment horizon (two to four months).

Mutual funds have received worldwide appreciation for their ability to provide consumers with savings and investment benefits. They provide a lot of liquidity because they have many different programs. In addition, some plans are so adaptable that you can cash out right away.

Here, to frame the best mutual funds for India in 2022, we consider the health of funds as per returns, expense ratio, exit load, tax benefits, CAGR, NAV, etc. Of course, investors have all options, but this is the fact if you have less risk, you may have less gain also. Remember, a mutual fund invests in a group of firms emphasizing quality of business, earnings growth, business model longevity, and fair pricing, following the philosophy “Buy Right, Sit Tight.”

Read Also: Best Mutual Funds to Invest in 2022 for Long Term.

while SEBI regulates mutual funds. Therefore, if a company wishes to be in the banking and mutual fund business, it must obtain separate license permits from the appropriate regulators and operate the two businesses as separate entities.

As per AMFI, the shortest duration for mutual fund investments is one day, and the highest duration is ‘perpetual.’

The vast majority of mutual funds are liquid investments, meaning they can be taken out at any moment. On the other hand, certain funds have a lock-in period, like ELSS funds have 3 yr lock-in period.

Time is when your financial advisor asks you to do or when you think the goal is achieved.

Market forces determine any security’s price,’ and the market reacts to any news or development, making it difficult to foresee the market’s direction. As a result, every investor should be aware that the security price is constantly subject to risk. However, investors should also be aware that Mutual Funds are meant to minimize this risk.

You don’t need to have a fat wallet; investors can invest as little as ₹ 100 per month by creating a SIP.

In this article, you will get a brief idea about the lower risk and higher potential of mutual funds in India in 2022.

Disclaimer

All the information are used for education purpose only. Investing in mutual funds poses a risk of financial losses. Investors must therefore exercise due caution. InvestoAxis is not liable or responsible for any losses caused as a result of decisions based on the article.

The basic idea behind InvestoAxis is to help people to be financially independent and achieve success.

Mon – Sat: 8 am – 5 pm,

Sunday: CLOSED

©2023 investoaxis. All rights reserved. | made with ❤️ by Subhendu pan